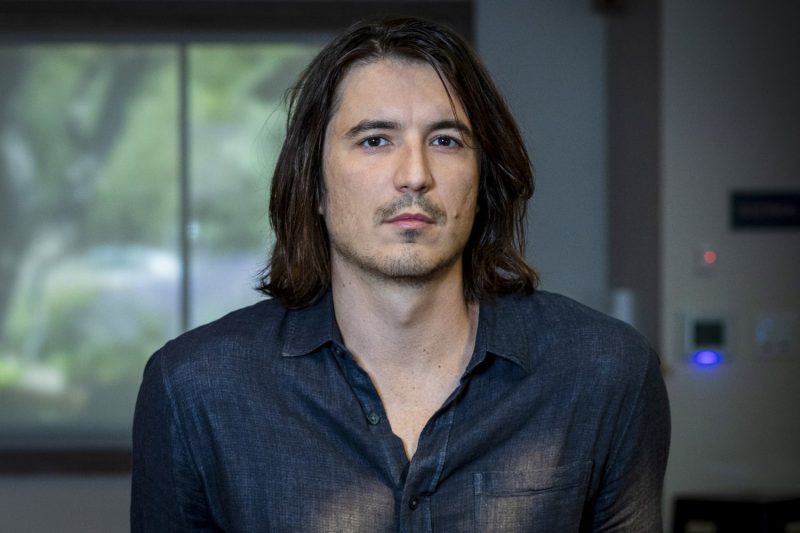

Robinhood CEO Vlad Tenev is betting that by rolling out a large enough portfolio of digital investment products, more consumers will be willing to pay a monthly subscription for its product suite.

Subscribers to Robinhood Gold pay $5 a month or $50 a year for perks like 4% interest on uninvested cash, access to professional research, and no interest on the first $1,000 of margin borrowed.

Now the company is adding wealth management features called Robinhood Strategies, which offers curated access to exchange-traded fund portfolios and mixes of handpicked stocks. The service, available to Gold Subscribers, carries a 0.25% annual management fee, capped at $250.

Robinhood also said this week that with its new Robinhood Banking offering, Gold subscribers will get private banking services with tax advice and estate planning tools, perks like access to private jet travel, five-star hotels and tickets to Coachella, and 4% interest on savings accounts. Customers will also soon be able to get cash delivered to their doorstep, saving them a trip to the ATM, though few details were provided.

Tenev told CNBC in an interview that Robinhood’s subscription service could be similar to what users get from Amazon Prime or Costco membership, where their monthly fee feels justified by the quality and quantity of the perks, which keep them coming back.

“My philosophy behind it is subscriptions are about loyalty,” Tenev said. “So if you’re a subscriber to something, then that service is sort of the first in mind when you think about trying something else from that category.”

Tenev said that in financial services, loyalty is particularly important because it’s “equivalent to wallet share.”

Tenev said the number of subscribers increased from about 1.5 million a year ago to 3.2 million today, adding that it’s a “nine-figure business,” meaning at least $100 million in annual revenue.

Robinhood grew in popularity among younger investors by making it easy to buy and hold fractional shares in companies using a simple mobile app, and then moving into crypto. Tenev said on Thursday that over the longer term, Robinhood wants to be “the place where you can buy, sell, trade, hold any financial asset, conduct any financial transaction.”

Robinhood shares are up 19% this year after almost tripling in 2024, when crypto prices soared.