Tonight’s digest captures markets and geopolitics colliding in real time.

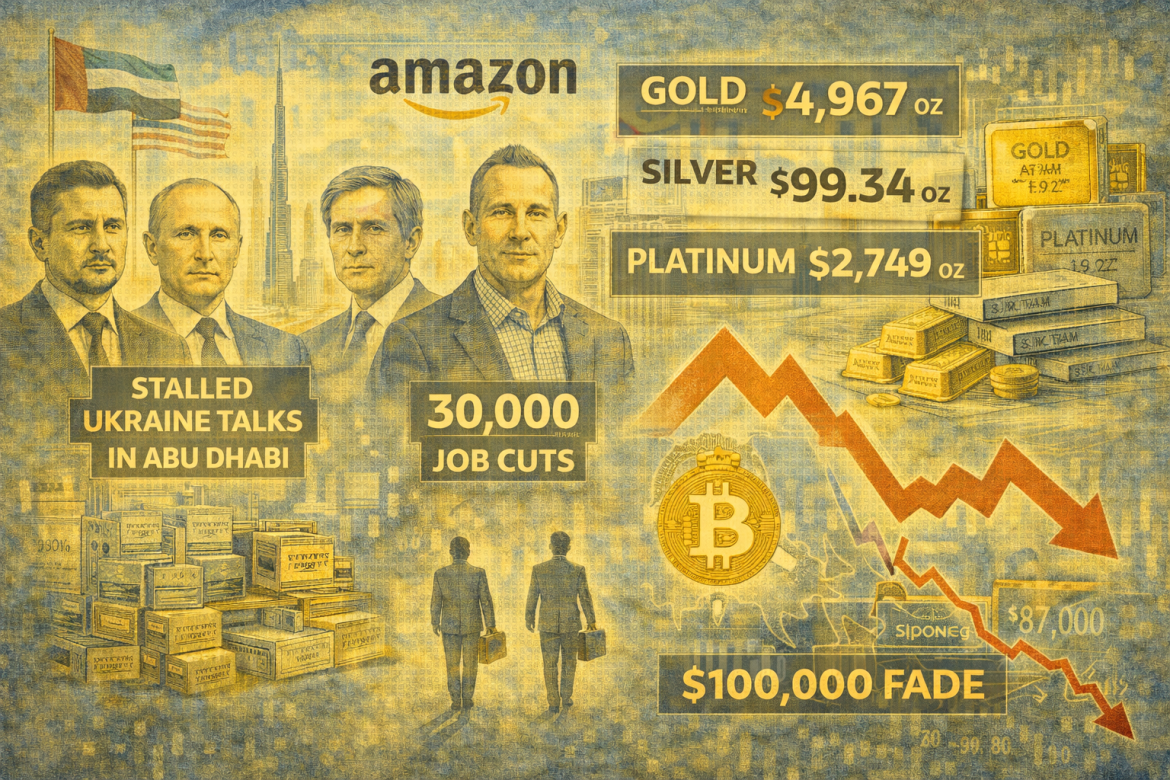

In Abu Dhabi, Zelenskyy’s trilateral talks with Russia and the US deliver optics, not breakthroughs, as territorial red lines harden into a durable stalemate.

In corporate America, Amazon’s sweeping job cuts underscore that Big Tech’s efficiency drive is structural, not cyclical.

Meanwhile, investors are stampeding into safe havens, sending precious metals to record highs, while Bitcoin’s $100,000 narrative fades fast under renewed macro pressure.

Zelenskyy gambles on Abu Dhabi as territorial stalemate deepens

First trilateral talks in four years kicked off Friday night in Abu Dhabi, with Ukraine, Russia, and the US finally in the same room.

But don’t mistake the optics for momentum. Zelenskyy just confirmed what everyone already knew: territory is the deal-breaker.

Putin demands Ukraine cede the remaining 25% of Donetsk it controls; Zelenskyy flatly refuses, citing constitutional grounds and battlefield realities, his forces hold land Russia couldn’t take in years of brutal grinding.

The security guarantees? Done. The reconstruction plan? Nearly finalized. The land? Unsolvable.

Witkoff’s pre-talks hint that “most issues” are settled was a cover for deep divisions.

Zelenskyy countered with dark humor in Davos: “Russians must compromise too, not just Ukraine.” Mathematically, this is theater.

Amazon’s 30,000-job purge accelerates

Amazon’s swinging the axe again.

After cutting 14,000 white-collar jobs in October, the e-commerce giant is set to eliminate another 14,000 corporate roles starting January 27, bringing its total restructuring target to nearly 30,000, the largest layoff in company history.

The second wave will hammer AWS, retail, Prime Video, and the People Experience and Technology (HR) division.

Jassy is shifting the blame from AI to “cultural fit” and bureaucratic bloat, claiming the pandemic created layers of middle management that slow decision-making.

Employees facing termination got 90 days of full pay and severance, with preferential consideration for internal transfers.

Translation for markets: Amazon’s remaking its workforce while profitable, signaling that tech’s efficiency obsession is structural, not cyclical.

Precious metals breaking records on geopolitical chaos

Gold shattered its all-time high Friday, kissing $4,967 per ounce, a 14.2% jump in just 23 days.

Silver hit $99.34, within spitting distance of the mythical $100 threshold.

Platinum posted a fresh record at $2,749. The holy trinity of safe havens is screaming capital flight from US assets. Fed rate-cut expectations for late 2026 are evaporating real yields, making non-yielding gold suddenly attractive.

But here’s the nuance: India’s precious metals market is getting flooded with financial flows, ₹15,000-16,000 crore poured in December alone, rather than traditional jewelry demand.

Silver’s industrial narrative (solar, EVs, electronics) is layering onto safe-haven buying, explaining its 150% outperformance versus gold over 12 months.

Bitcoin’s $100K dream deflates as macro headwinds resurface

Bitcoin’s collapse from $97,000 to $89,000 in eight days has flipped the narrative hard.

Prediction market odds for a dump to $69,000 tripled in 24 hours, from 11.6% last Thursday to 30% Friday, signaling capitulation among retail and semi-pro traders.

The whipsaw is brutal: Trump’s tariff threats triggered $865 million in liquidations; his pause sent BTC bouncing to $90K; then reality set in.

Open interest in derivatives has stalled between 240,000-265,000 BTC for ten straight days, meaning zero new money flowing in.

Gold’s record-breaking rally is cannibalizing risk appetite; investors are rotating into safe havens, not digital assets. The structural case for $100,000 looked airtight two weeks ago.

The post Evening digest: Bitcoin slides below $90K, Amazon layoffs mount, gold at record highs appeared first on Invezz